ManipalCigna Prime Senior Coverages

Any Room upgrade

Prime Senior gives you complete peace of mind by allowing you to opt for “Any Room” category, suite or above, as you deem fit.

Unlimited restoration even for same illnesses

Prime Senior coverage restores to 100% of Sum Insured unlimited times if at any point, you are short of coverage. And that’s for both related and unrelated illnesses / injuries. Applicable from 2nd claim onwards.

Enhanced Donor Expenses Coverage

Now, not just hospitalization but pre & post, screening and complications in respect of the donor for an organ transplant is also covered

Flexible Health Check-up

A preventive Health Check-up facility at our Network Providers. No more taking the health for granted.

Cumulative Bonus up to 10% of Sum Insured

Cumulative Bonus of 10% of Sum Insured maximum up to 100% of Sum Insured

Unlimited Tele-consultation

Through phone or chat mode, available through our network providers including specialists

Premium Management

One can manage their premiums and avail an inclusive cum affordable plan by opting for premium management option. With this the room category will limit to ₹ 3000 per day.

Reduction in PED waiting period

With this option, no more long waiting periods. Now Pre-existing diseases can be covered after 90 days waiting period.

ManipalCigna Prime Senior Features

Pre, Post & In-patient Hospitalization

Get cover up to Sum Insured for pre, post, & in-patient hospitalization – for 30 days before & 60 days after the hospitalization in classic Plan, and for 60 days before & 90 days after the hospitalization in the Elite Plan.

Room Accommodation

Get a single private room with AC & ICU room up to Sum Insured. Option to upgrade the room category to ‘Any Room’ as you deem fit.

Daily Hospital Cash

Get daily hospital of ₹ 800 per day, maximum up to ₹ 5,600.

Air Ambulance

Elite plan users can get Air Ambulance cover up to ₹10L.

Access To Better Treatments

This is a comprehensive plan that provides coverage for modern & advanced treatments/mental illness, HIV/AIDS & STDs up to the Sum Insured.

Payment Options and Tenure

Pay a single premium each year or divide it into half-yearly, quarterly, or monthly payments, along with policy tenure of your choice – either 1, 2, or 3 years.

Road Ambulance & Donor Expenses

Road ambulance & donor expenses are covered up to the Sum Insured.

Plan Comparison

| PLAN NAME | Prime Senior Classic |

Prime Senior Elite |

|

|---|---|---|---|

| SUM INSURED | 3 Lacs - ₹ 50 Lacs | 5 Lacs - ₹ 50 Lacs | |

| ROOM ACCOMMODATION | Single Private AC Room ICU: Up to SI | Single Private AC Room ICU: Up to SI | |

| PRE - HOSPITALIZATION | 30 days; Up to SI | 60 days; Up to SI | |

| POST - HOSPITALIZATION | 60 days; Up to SI | 90 days; Up to SI | |

| DAY CARE TREATMENT | Up to SI | Up to SI | |

| DOMICILIARY HOSPITALIZATION | Up to SI | Up to SI | |

| DONOR EXPENSES | Up to SI | Up to SI | |

| RESTORATION OF SUM INSURED | Not Available | Unlimited times for related/unrelated illnesses | |

| AYUSH COVER | Up to SI | Up to SI | |

| AIR AMBULANCE COVER | Not Available | Up to SI, subject to a maximum of 10 Lacs | |

| DAILY CASH FOR SHARED ACCOMMODATION | Not Available | Per Hospitalization: 800 per day max 5600 | |

| HEALTH CHECK UP | Once in every claim free year (Available from 2nd year onwards) | Once in a policy year (Available from 1st year onwards) | |

| DOMESTIC SECOND OPINION | Not Available | Available for 36 listed Critical Illnesses | |

| TELE- CONSULTATION | Unlimited | Unlimited | |

| CUMULATIVE BONUS | 10% of SI for every claim free year maximum up to 100%(Bonus will not reduce in case of claim) | Guaranteed: 10% of SI for every year maximum up to 100% | |

| PREMIUM WAIVER BENEFIT | Not Available | Waives off next one year renewal policy premium upon occurrence of any of the listed contingencies | |

| Optional Covers | |||

| ANY ROOM UPGRADE | Upgrade to "Any Room" | Upgrade to "Any Room" | |

| PREMIUM MANAGEMENT | Room Accommodation limit option: 3000 per day ICU Limit: Up to SI | Not Available | |

| RESTORATION OF SUM INSURED | Unlimited times for related/unrelated illnesses | Not Available | |

| REDUCTION IN PED WAITING PERIOD | Reduce the PED waiting period to 90 Days | Reduce the PED waiting period to 90 Days | |

| Eligibility | |||

| PED WAITING PERIOD | 24 Months | 24 Months | |

| POLICY TYPE | Individual, Multi individual and Family Floater (2A- Self and Spouse) | Individual, Multi individual and Family Floater (2A- Husband and wife) | |

Discounts made better

Standing Instruction Discount

Standing Instruction Discount: Get a discount of 3% on the renewal premium, if it is received via a Standing Instruction.

Long term discount

Avail a long term discount of 7.5% on the total premium for a one-time 2 year policy term payment and enjoy a 10% on the total premium for a one-time 3 year policy term payment

Family Discount

For multi-individual policies within a family comprising 2 or more members, enjoy a discount of 10% on the total premium.

Claiming Process done easy

1800-419-1159 (toll-free number) Cigna@mediassistindia.com

Start your simple settlement process here.

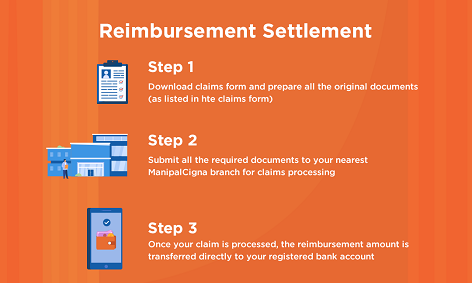

Reimburse your medical bills in three easy steps.

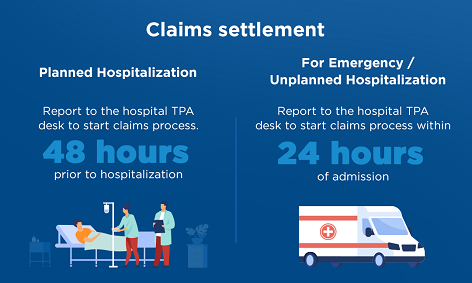

Get cashless settlement easily whether for planned or unplanned hospitalization.

Assured claims granted in 90 minutes. Check claim status easily.

Frequently Asked Questions

Why should one buy ManipalCigna Prime Senior Product?

ManipalCigna Prime Senior is designed specifically for the senior citizens to help this segment live golden years of their life worry-free. It is a comprehensive product that is designed to address various challenges of senior citizens such as room category flexibility, hassle-free purchase of plan, flexibility in terms of premium management, premium paying options and so on.

The plan has 2 variants – classic plan to ensure inclusive cum affordable coverage and elite plan which is a superior plan that enhances the benefits available in Classic plan and also provides a host of added features.

There are optional covers which makes the product highly customizable.

Can I buy ManipalCigna Prime Senior Online?

You can buy ManipalCigna Prime Senior Online by visiting our website www.manipalcigna.com.

What coverages does one get?

Under this policy, coverages are divided into Basic, Value added, Optional and Add-on/Rider. The optional covers and ManipalCigna Health 360 Add-on/rider can be opted by paying additional premium.

Is there any exit age in this policy?

No, there is no exit age in this policy.

Is there any tax Benefit?

Yes. Premium paid under the Policy shall be eligible for income tax benefit under Sec 80 D of the Income Tax Act and any amendments thereon. If Policy Term is more than 1 year then tax benefit can be taken for all the years separately as applicable.

Are you wondering which room should you opt while getting admitted in the hospital?

We understand you and ensure you have complete peace of mind by allowing you to opt for “Any room” category without any extra deductions. Which means, when one opts for higher category room than eligible, you get charged for the additional difference pertaining to the difference in room rent only. No additional proportionate deductions on the doctor visits, nursing, etc.

What can you do if the entire Sum Insured gets exhausted in a year due to multiple hospitalizations and claims?

With Prime Senior we restore 100% of Sum Insured after 1st claim in a policy year, if at any point in time you are short of the coverage. This is possible in case of both related and unrelated illnesses and accidents.